Nirmala Sitharaman announces Rs 6.3 lakh cr package

In the wake of the 2nd wave of Covid-19, government announced the package to revive the economy with emphasis on health and tourism

THC Bureau | June 28, 2021 10:31 pm

Finance Minister Nirmala Sitharaman announcing economic relief package in New Delhi today (PIB)

In a bid to revive the economy in the wake of the 2nd wave of Covid-19 pandemic, the government today announced 17 measures with emphasis on health and tourism. Finance Minister Nirmala Sitharaman said that the measures amounted to Rs 628,993 crore. These included the additional subsidy for DAP and P&K fertilizers, and the extension of the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) from May to November 2021, according to an official release.

The measures can be clubbed into three broad categories: economic relief from the pandemic, strengthening public health, and impetus for growth & employment.

Eight out of 17 schemes announced here today aim at providing economic relief to people and businesses affected by the Covid-19 pandemic, the release said. “Special focus is on health and reviving travel, tourism sectors.”

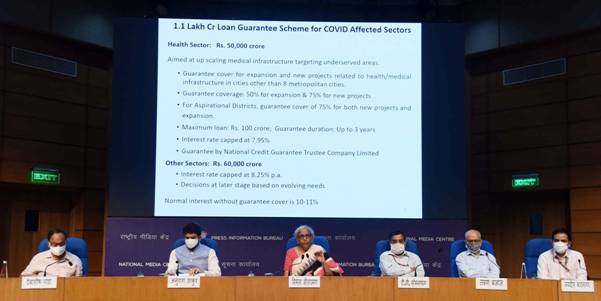

Rs 10 lakh crore Loan Guarantee Scheme for Covid-affected sectors

Under this new scheme, additional credit of Rs 1.1 lakh crore will flow to the businesses. This includes Rs 50,000 crore for health sector and Rs 60,000 crore for other sectors, including tourism.

The health sector component is aimed at up scaling medical infrastructure targeting underserved areas. Guarantee cover will be available both for expansion and new projects related to health/medical infrastructure in cities other than eight metropolitan cities. While the guarantee cover will be 50 per cent for expansion and 75 per cent for new projects, in the case of aspirational districts, it will be 75 per cent for both new projects and expansion. Maximum loan admissible under the scheme is Rs 100 crore and the guarantee duration is up to three years. Banks can charge a maximum interest of 7.95 per cent on these loans. Loans for other sectors will be available with an interest cap of 8.25 per cent p.a. Thus the loans available under the scheme will be much cheaper compared to the normal interest rates without guarantee of 10-11 per cent.

Scheme for Tourists guides/ stakeholders

Another new scheme announced today aims at providing relief to people working in tourism sector. Under new Loan Guarantee Scheme for Covid-affected sectors, working capital/personal loans will be provided to people in tourism sector to discharge liabilities and restart businesses impacted due to Covid-19. The scheme will cover 10,700 regional level tourist guides recognized by the Ministry of Tourism and state governments, and about 1,000 travel and tourism stakeholders (TTS) recognized by Ministry of Tourism. TTSs will be eligible to get a loan up to Rs 10 lakh each while tourist guides can avail loan up to Rs 1 lakh each. There will be no processing charges, waiver of foreclosure/prepayment charges and no requirement of additional collateral. The scheme will be administered by the Ministry of Tourism through NCGTC.

Free one-month tourist visa to 5 lakh tourists

This is another scheme aimed at boosting the tourism sector. It envisages that once visa issuance is restarted, the first 5 lakh tourists bisas will be issued free of charge to visit India. However, the benefit will be available only once per tourist. The facility will be applicable till March 31, 2022, or till 5 lakh visas are issued, whichever is earlier. Total financial implications of the scheme to the government will be Rs 100 crore.

Emergency Credit Line Guarantee Scheme (ECLGS)

The government has decided to expand the Emergency Credit Line Guarantee Scheme (ECLGS), launched as part of Aatma Nirbhar Bharat Package in May 2020, by Rs 1.5 lakh crore. ECLGS has got a very warm response with Rs 2.73 lakh crore being sanctioned and Rs 2.1 lakh crore already disbursed under the scheme.

Under the expanded scheme, the limit of admissible guarantee and loan amount is proposed to be increased above existing level of 20 per cent of outstanding on each loan. Sector-wise details will be finalized as per evolving needs. The overall cap of admissible guarantee is thus raised from Rs 3 lakh crore to Rs 4.5 lakh crore.

Credit Guarantee Scheme for micro finance institutions

This is a completely new scheme announced today which aims to benefit the smallest of the borrowers who are served by the network of micro finance institutions (MFIs). Guarantee will be provided to scheduled commercial banks for loans to new or existing NBFC-MFIs or MFIs for on lending up to Rs 1.25 lakh to approximately 25 lakh small borrowers.

Loans from banks will be capped at MCLR plus 2 per cent. Maximum loan tenure will be three years, and 80 per cent of assistance will be used by MFIs for incremental lending. Interest rates will be at least 2 per cent below the maximum rate prescribed by Reserve Bank of India. The scheme focuses on new lending, and not on repayment of old loans.

Another feature of the scheme is that all borrowers (including defaulters up to 89 days) will be eligible. Guarantee cover will be available for funding provided by MLIs to MFIs/NBFC-MFIs till March 31, 2022, or till guarantees for an amount of Rs 7,500 crore are issued, whichever is earlier. Guarantee will be provided up to 75 per cent of default amount for up to 3 years through National Credit Guarantee Trustee Company (NCGTC)

No guarantee fee to be charged by NCGTC under the scheme.

Extension of Aatma Nirbhar Bharat Rozgar Yojana

Aatma Nirbhar Bharat Rozgar Yojana was launched on Oct 1, 2020. It incentivizes employers for creation of new employment, restoration of loss of employment through EPFO. Under the scheme, subsidy is provided for two years from registration for new employees drawing monthly wages less than Rs 15,000 for both the employer’s and the employee’s share of contribution (total 24 per cent of wages) for establishment strength up to 1,000 employees; and only the employee’s share (12 per cent of wages) in case of establishment strength of more than 1,000. Benefit of Rs 902 crore has been given to 21.42 lakh beneficiaries of 79,577 establishments under the scheme. The government has decided to extend the date of registration under the scheme from June 30 this year to March 31, 2022.

Additional subsidy for DAP & P&K fertilizers

Additional subsidy to farmers for DAP and P&K fertilizers was announced recently. Details of the same were furnished.

Free food-grains under Pradhan Mantri Garib Kalyan Yojana extended till Nov

In the last fiscal, the government spent Rs 133,972 crore under PMGKY to ameliorate the hardships faced by the poor due to economic disruption caused by Covid-19. In the wake of the second wave of the pandemic, the scheme was re-launched in May 2021 to ensure food security of the poor. Five kg of food grains will be provided free of cost to NFSA beneficiaries from May to November 2021. Estimated financial implications of the scheme will Rs 93,869 crore, bringing the total cost of PMGKY to Rs 2,27,841 crore.

Strengthening public health

Rs 23,220 crore more has been earmarked for public health with emphasis on children and pediatric care and beds

Rs 88,000 crore boost to export insurance cover

Export Credit Guarantee Corporation (ECGC) promotes exports by providing credit insurance services. Its products support around 30 per cent of India’s merchandise exports. It has been decided to infuse equity in ECGC over five years to boost export insurance cover by Rs 88,000 crore.

Rs 3 lakh crore for reform-based result-linked power distribution

The revamped reforms-based, result-linked power distribution scheme of financial assistance to Discoms for infrastructure creation, upgrade of system, capacity building, and process improvement was announced in Budget 2021-22. It aims at state-specific intervention in place of ‘one size fits all.’ Participation in the scheme is contingent to pre-qualification criteria like publication of audited financial reports, upfront liquidation of state governments’ dues/subsidy to Discoms, and non-creation of additional regulatory assets.

Total outlay for the scheme is Rs 3,03,058 crore, out of which the Central government’s share will be Rs 97,631 crore. The amount available under the scheme is in addition to the allowed additional borrowing of 0.5 per cent of gross state domestic product which will be available to states annually for the next four years subject to carrying out specified power sector reforms. The amount of borrowings available this year for this purpose is Rs 105,864 crore.

New streamlined process for PPP projects and asset monetization

Current process for approval of public private partnership (PPP) projects is long and involves multiple levels of approval. A new policy will be formulated for appraisal and approval of PPP proposals and monetization of core infrastructure assets. The policy will aim to ensure speedy clearance of projects to facilitate private sector’s efficiencies in financing construction and management of infrastructure.