‘Unions were consulted on PF withdrawals’

Ravi Shanker Kapoor | April 22, 2016 2:36 pm

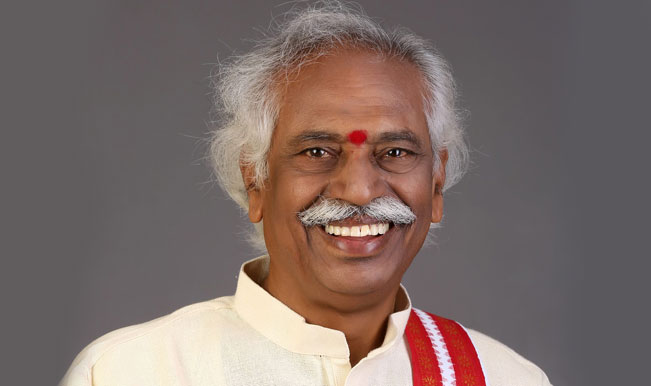

Minister of State (Independent Charge) Labor & Employment Bandaru Dattatreya has strongly refuted the allegation that the new rules governing the withdrawal of provident fund were announced without consulting trade unions.

Speaking to a select group of journalists in New Delhi, he said the charge that the decision was unilateral is “totally false.” The unions were duly consulted, and they agreed in principle that premature withdrawals should be curbed, he added.

“This is the reason that the decision has been put in abeyance and not rolled back,” he pointed out.

The government had issued a notification dated February 10, 2016, regarding rules for withdrawal from the Employee Provident Fund by employees. Under the revised rules, the employee was permitted to withdraw the employees’ share from the fund (which is 12 per cent of the wages). However, it was prescribed that the employers’ share of contribution towards the provident fund (which is 3.67 per cent of the wage) would be allowed to be withdrawn only at the age of retirement (58 years).

The objective was to provide a minimum social security to the workers at the time of retirement. It was noticed that over 80 per cent of the claims settled by Employees’ Provident Fund Organization belonged to premature withdrawal of funds, treating the EPF accounts as savings accounts, and not a social security instrument, said Dattatreya.

‘Unions were consulted on PF withdrawals’

Minister of State (Independent Charge) Labor & Employment Bandaru Dattatreya has strongly refuted the allegation that the new rules governing the withdrawal of provident fund were announced without consulting trade unions.

Speaking to a select group of journalists in New Delhi, he said the charge that the decision was unilateral is “totally false.” The unions were duly consulted, and they agreed in principle that premature withdrawals should be curbed, he added.

“This is the reason that the decision has been put in abeyance and not rolled back,” he pointed out.

The government had issued a notification dated February 10, 2016, regarding rules for withdrawal from the Employee Provident Fund by employees. Under the revised rules, the employee was permitted to withdraw the employees’ share from the fund (which is 12 per cent of the wages). However, it was prescribed that the employers’ share of contribution towards the provident fund (which is 3.67 per cent of the wage) would be allowed to be withdrawn only at the age of retirement (58 years).

The objective was to provide a minimum social security to the workers at the time of retirement. It was noticed that over 80 per cent of the claims settled by Employees’ Provident Fund Organization belonged to premature withdrawal of funds, treating the EPF accounts as savings accounts, and not a social security instrument, said Dattatreya.