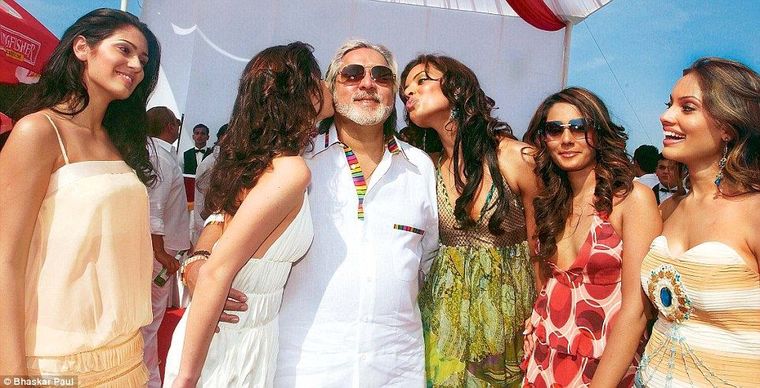

King-size lifestyle… at taxpayer’s expense

Ravi Shanker Kapoor | March 11, 2016 8:10 am

Will the Vijay Mallya scandal have an ending different from most other scandals? One has to be quite bullish to answer in the affirmative.

From drawing rooms and television studios to Parliament, everywhere the subject is being discussed. Which is a good thing. We should remember that were it not for the lavish lifestyle of Mallya, the former chairman of United Spirits, the world’s second-largest spirits company, the cozy relations between politicians, businessmen, and sarkari bankers would not have come to the fore. How many people know about the promoters of Bhushan Steel whose debt is in the region of Rs 40,000 crore? The king is visible to all.

This is the reason that the loot of public and government money by bigger corporate crooks seldom makes it to the front pages of newspapers, the prime time of news channels, and the Houses of Parliament. Mallya did point this out in his defence.

In an open letter, he said, “In fact, banks have NPAs of Rs 11 trillion and have borrowers who owe much more than the amount allegedly owed by Kingfisher Airlines to the banks—a fact never alluded to or widely reported by the media as in my case.” He went on to add: “None of these large borrowers (whose debt is significantly more than the KFA debt) have been declared willful defaulters, but unfortunately, UB Holdings and I have been declared willful defaulters by certain banks on technical grounds. I have legally challenged these declarations.”

It is like a murderer arguing, “I killed only five people, whereas Dawood Ibrahim has killed 500. So, why is everybody after my life while he hasn’t been punished?”

The problem, however, is not as much with the defaulters as with the economic policy that socialism has birthed and nurtured in our country. There are corporate frauds all over the world, but it is in India that 500 hearings and 180 adjournments take place at debt recovery tribunals—to little avail. The process to recover debt from big corporations is long and cumbersome—the bigger the company, the bigger the troubles for lenders. Corruption at all levels ensures that nobody who steals enough gets penalized. And the entire political class has maintained the status quo for ages, its loud protestations of safeguarding public money notwithstanding.

Bank nationalization is another big problem. Top bosses of public sector banks (PSBs) have few incentives to resist orders from their political bosses. At any rate, they don’t have any stake in the banks. If Yes Bank goes down, its founder, managing director & CEO Rana Kapoor would be in trouble; if State Bank of India shuts down, it would be embarrassing for chairperson Arundhati Bhattacharya, but not much more than that. The private sector is guided by the risk-reward concept; the public sector by procedures, that is, when its functioning is not warped by ministers and ministries.

The results show in non-performing assets (NPAs). A loan becomes and NPA when there is a default for more than 90 days of due date. The NPAs of PSBs were 3.45 per cent of their net lending in 2015, while the corresponding figure for private banks was lower than 1 per cent.

It needs to be mentioned that the NPAs of private banks have grown over the years because of slowdown, especially sluggishness in industry. Yet, private banks have managed to keep the NPAs within 1 per cent. The reason is simple: private banks do not suffer from political interference and the red tape.

Well, wrong decisions are also made by private bankers; besides, there are factors beyond their control as also of the control of the businessmen whom they lend money. This is evident from their NPAs, however low. But whatever losses they may incur, because of bad luck or incompetence, the burden is on the promoters and investors.

In the case of PSBs, however, it is ultimately the taxpayer who ends up bearing the burden of incompetence, venality, neta-banker-tycoon nexus, red tape, etc. It is indeed depressing to know that the opulence of the Mallyas is financed by the people of India, a large section of them being poor.

Unless meaningful steps are taken to privatize PSBs and to quicken the process to preclude, check, and prosecute financial fraud, there would be no end to the taxpayer’s torment. Ministers and Opposition leaders will continue to make sanctimonious statements regarding propriety, public money, etc., but the Mallyas will continue to thrive.